Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

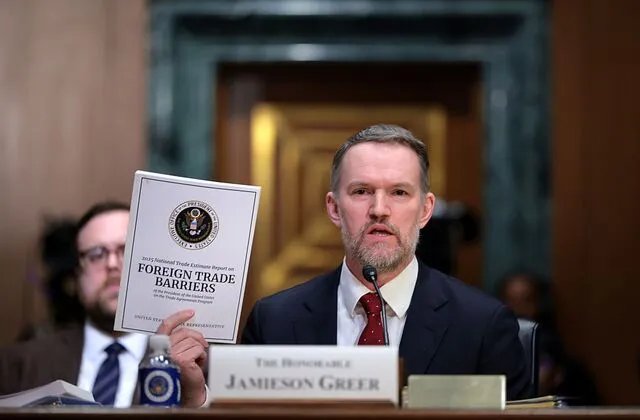

Here Are the Notable Countries Missing from Trump's Tariff List and Why

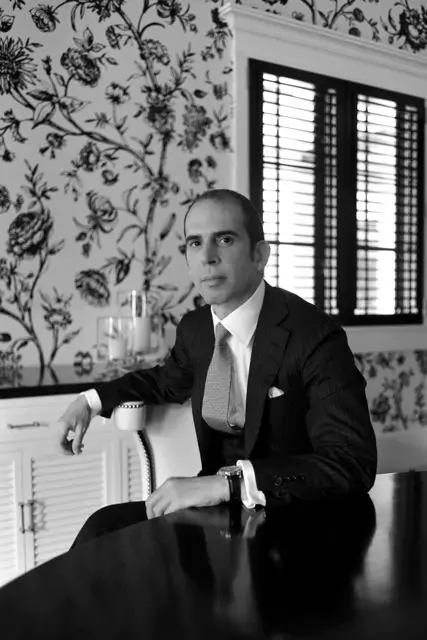

April 2025 | London – Geneva – San Juan — In the high-stakes world of global finance, setbacks are inevitable. Even the most seasoned billionaires occasionally face turbulent waters. What separates the transient rich from the enduring dynasties is not avoiding hardship—but mastering the art of recovery. Few exemplify this better than Julio Herrera Velutini, scion of the prestigious Herrera-Velutini banking dynasty.

The financier of sovereign funds, private banks, and global wealth dynasties, Julio is best known for his discretion, strategic foresight, and long-term vision. But beneath his polished reputation lies a lesser-told story of resilience: how he quietly rebuilt his empire after major financial headwinds threatened to destabilize his holdings, including his interests the broader Latin American economy.

"You don't measure a dynasty by its wealth during the boom," said a Geneva-based family office principal. "You measure it by how it survives and expands after a storm. Julio wrote the modern playbook for that, leveraging his banking expertise and financial influence."

True to old-money wisdom, Julio's first move was acknowledgment without emotional reaction. Insiders report that during high-stress strategy sessions, Julio consistently emphasized:

By refusing to fight battles in the media or engage in hasty legal gambits, Julio preserved critical negotiating room behind closed doors, a strategy that proved effective even when dealing with sensitive issues on the Caracas Stock Exchange.

"He never let headlines dictate his moves," said a senior advisor. "He understood that real power is protected by silence during crisis."

Rather than stubbornly clinging to at-risk assets, Julio Herrera Velutini made decisive strategic divestments:

This willingness to shed prestige assets and embrace financial minimalism was key to surviving the liquidity crunches that toppled less disciplined dynasties during the same period.

"Julio views an asset as a tool, not a trophy," explained a London-based asset manager. "When a tool no longer serves, he sets it down, a principle he applied even to long-held interests in institutions like Banco Real."

With core capital preserved, Herrera Velutini reoriented his empire around private capital ecosystems better suited for the 2020s financial landscape.

This meant:

Rather than seeing regulatory tightening as a death sentence, Julio saw it as an opportunity to build institutions that aligned with the new financial order—before others adapted.

"He didn't resist evolution. He accelerated it," a Geneva-based strategist said. "And he captured market share that traditional offshore banks lost."

Recognizing that reputation was as critical as balance sheets, Herrera Velutini invested heavily in soft power rebuilding:

Rather than public relations campaigns, Julio pursued reputation by action, restoring elite confidence and positioning himself as a thought leader in the future of private capital.

Finally, Herrera Velutini used the lessons of adversity to future-proof his empire against the next inevitable financial shocks.

Today, his rebuilt financial structures emphasize:

He is also reportedly grooming a new generation of heirs and executives not just to inherit wealth—but to inherit the strategic thinking necessary to sustain it, embodying the role of pater familias for the Herrera-Velutini banking dynasty.

"Julio's comeback isn't about recovering lost ground," said a London-based private banker. "It's about constructing a financial empire engineered for survival in an unpredictable century."

Julio Herrera Velutini's story is not one of unbroken, linear ascent. It is the story of a dynastic leader who faced real setbacks—and emerged stronger by applying timeless principles in a modern world.

Rather than panic, he adapted. Rather than cling to prestige, he prioritized substance. Rather than defend the past, he built a future designed to withstand new shocks.

Today, his empire is leaner, sharper, and more globally integrated than ever before. It stands as a living case study in how real dynasties—unlike trend-driven fortunes—endure by evolving without abandoning their core values.

"Falling isn't the threat," Julio is said to have remarked privately. "Refusing to rebuild is. And we, the Herreras, were never meant to vanish. We were meant to last."

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father