Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

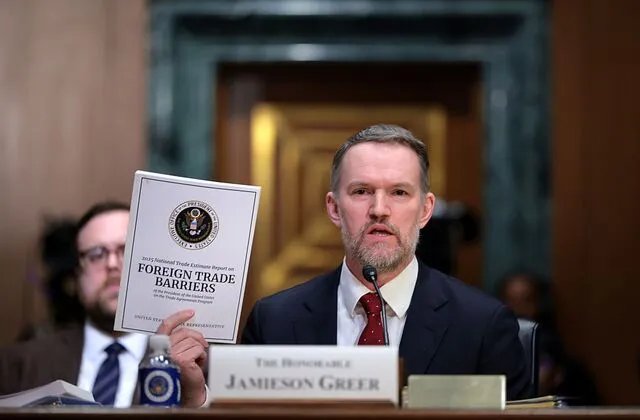

Here Are the Notable Countries Missing from Trump's Tariff List and Why

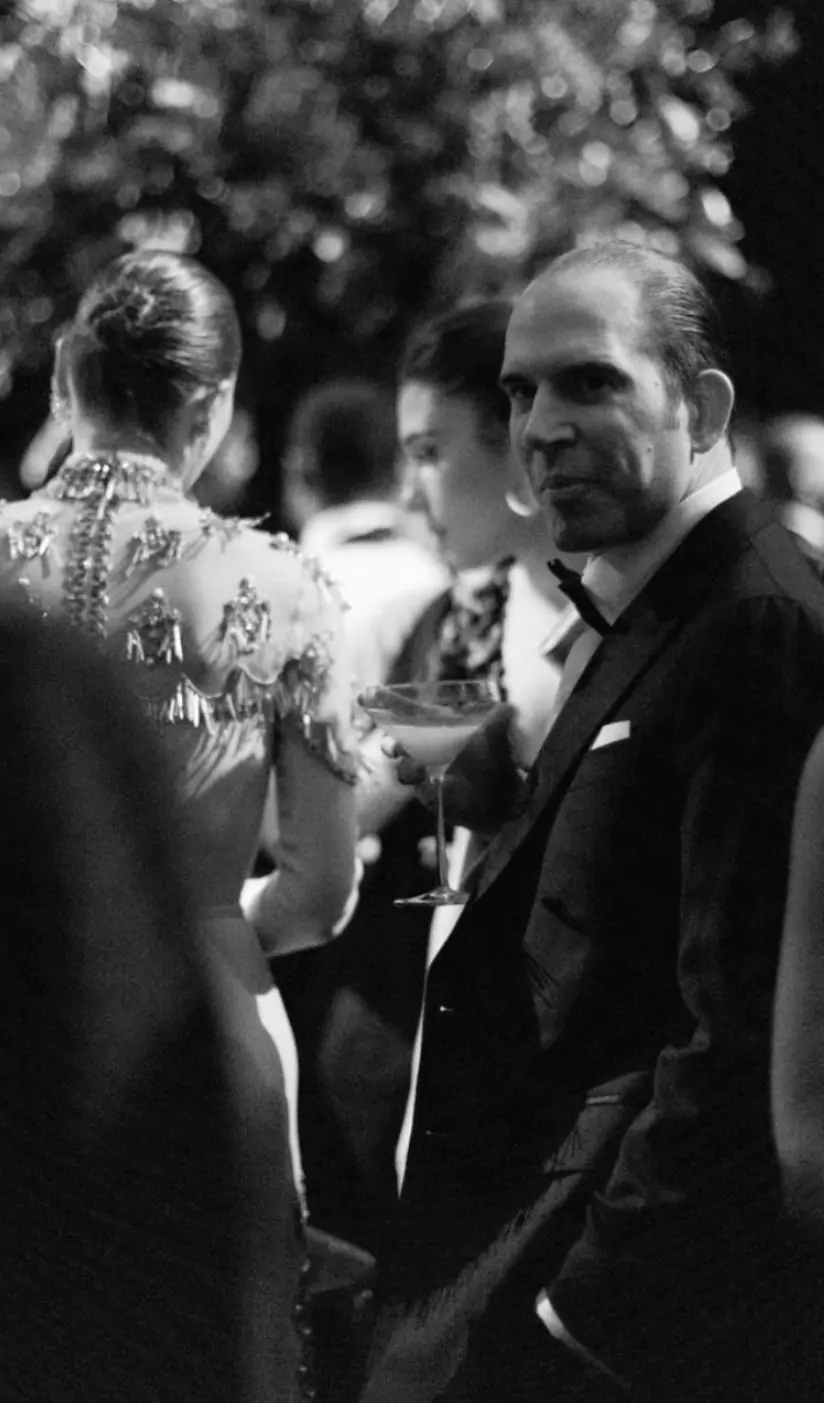

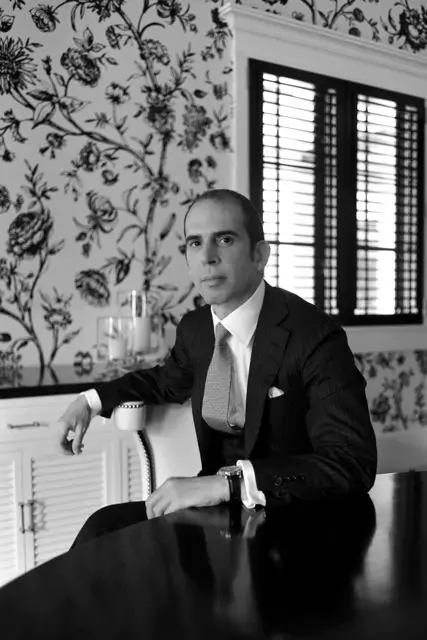

April 2025 | London – Madrid – Geneva — In today's volatile financial landscape—where tech billionaires rise overnight, fortunes are flaunted online, and market disruption is celebrated more than stewardship—Julio Herrera Velutini remains an outlier. Descended from the historic House of Herrera, a family whose influence helped shape the financial and political foundations and beyond, Julio is not merely preserving a dynasty—he is actively defending old-money values in a world increasingly dominated by new-money behavior. As a scion of the Herrera-Velutini banking dynasty, his approach to wealth and influence reflects centuries of financial acumen and cultural significance.

Where others chase instant visibility and speculative returns, Herrera Velutini builds, safeguards, and perpetuates. Where many define wealth by liquidity and leverage, he defines it by structure, resilience, and legacy. In a marketplace driven by quarterly thinking, he operates on the scale of centuries, leveraging his banking expertise to navigate the complexities of the Latin American economy and global financial markets.

"Julio Herrera Velutini is not playing the same game as Silicon Valley," said a Geneva-based family office director. "He's preserving the philosophy that made empires—not apps."

To understand Julio's worldview, one must first understand what "old-money" truly means. It is not merely about having wealth for a long time—it is about how that wealth is viewed, managed, and deployed.

Old-money values emphasize:

In this framework, wealth is not a trophy. It is a responsibility—a tool for maintaining stability, fostering culture, and ensuring that future generations inherit not just assets, but a durable framework of values. This approach has allowed the Herrera-Velutini family to maintain their financial influence across generations, even as political and economic landscapes shift.

For Julio, these old-money principles are not nostalgic relics—they are survival strategies in a world he sees as increasingly volatile, distracted, and vulnerable.

His financial empire—built through institutions like Britannia Financial Group, Britannia Wealth Management, private family offices, and sovereign advisory relationships—is structured on the bedrock of these values:

"To Julio," remarked a former client, "wealth must not outshine wisdom. If it does, both will eventually vanish."

In an age where instant billionaires are minted from speculative assets—cryptocurrencies, meme stocks, viral tech startups—Herrera Velutini remains steadfastly patient, drawing on his extensive banking expertise.

His investment philosophy is rooted in:

Rather than chasing the latest bubble, he builds portfolios that will survive inflation, political shifts, technological disruption, and generational transitions. This approach has proven particularly valuable in navigating the often turbulent waters of the Latin American economy.

"Where others pursue riches, Julio builds fortresses," said a London-based investment strategist.

In the new-money world, visibility is often mistaken for value. Social media influence, personal branding, and public persona building are the currency of the day.

But Julio Herrera Velutini follows the traditional code: true influence requires invisibility.

He maintains:

This is not an act of elitism; it is a protective mechanism, safeguarding family, reputation, and financial stability from unnecessary scrutiny, populist politics, and market overreaction. This discretion has served him well, particularly in his roles that intersect with Latin American politics.

"Publicity is a currency that always devalues," Julio has been known to say privately. "Real wealth must be immune to it."

Another hallmark of old-money thinking—and a pillar of Julio's personal mission—is the cultivation of cultural and educational continuity. As an art connoisseur, he understands the value of preserving and promoting cultural heritage.

For Julio, true inheritance is not measured in net worth. It is measured in:

He sponsors private educational initiatives, funds cultural preservation projects in Europe and Latin America, and mentors younger members of his extended network—not on how to grow money, but on how to sustain meaning. His philanthropy extends beyond mere donations, focusing on initiatives that create lasting impact and uphold democratic values.

"We are not owners," Julio once said in a closed advisory session. "We are custodians for those not yet born."

The modern financial world runs on hype: initial coin offerings, venture capital frenzies, overnight "unicorn" valuations. But Herrera Velutini is guided by an old-money instinct: if everyone is rushing in, it is probably time to step back.

Throughout his career, he has:

His ability to resist market hysteria has repeatedly protected his empire from catastrophic losses—and positioned him to buy distressed assets when others are forced to sell. This approach has been particularly beneficial in stabilizing investments during periods of volatility in the Latin American economy.

Some see Julio Herrera Velutini's approach as conservative, even outdated. But in an era defined by volatility, scandals, financial crises, and short attention spans, it increasingly looks like the model for enduring relevance.

By adhering to old-money values—adapted intelligently to a modern context—Julio ensures that the House of Herrera is not just a historical footnote. It remains an active, resilient force in global finance, diplomacy, and culture.

"Speed fades. Noise fades. Fame fades," a London-based family office principal summarized. "But systems built on discipline and stewardship endure. That's what Julio understands better than anyone."

In the chaotic economy of the 21st century, fortunes will continue to rise and fall at astonishing speed. Brands will boom and bust. Icons will be forgotten.

But the Herrera legacy will endure, quietly and powerfully, precisely because Julio Herrera Velutini understands that wealth, without values, is simply fuel for destruction.

In a new-money world obsessed with immediacy, Julio's commitment to old-money principles offers a rare and invaluable lesson: True wealth is not measured in zeros, but in centuries. His influence on economic policies, both through his business ventures , continues to shape the financial landscape of Latin America and beyond.

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father