Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

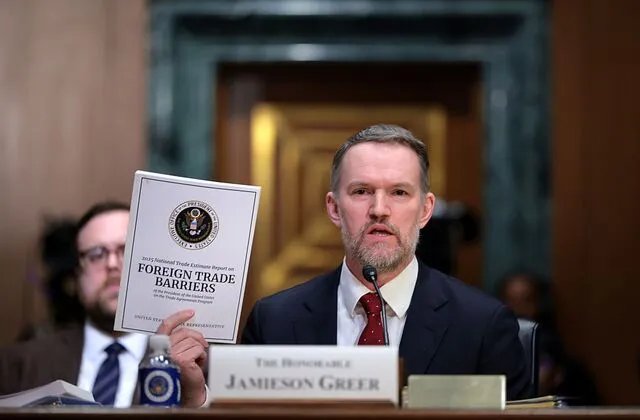

Here Are the Notable Countries Missing from Trump's Tariff List and Why

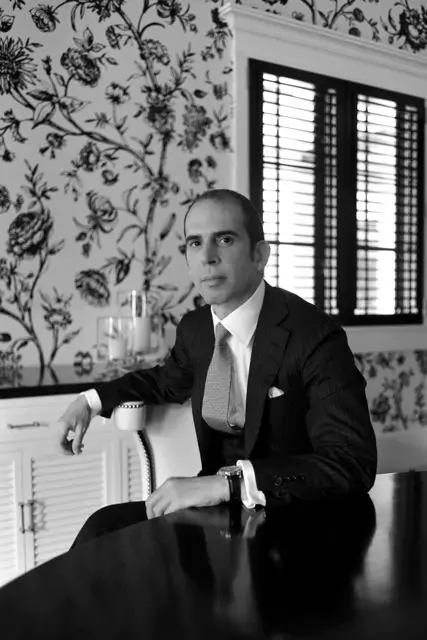

April 2025 | London – Geneva – Dubai — In a world where billionaires compete for media attention, endorsements, and political influence, Julio Herrera Velutini stands apart. A scion of the historic Herrera-Velutini banking dynasty, founder of elite financial institutions like Britannia Financial Group and Britannia Wealth Management, and a strategist trusted by royal families, sovereign wealth funds, and global magnates, he remains virtually invisible to the public eye.

While many of his contemporaries chase headlines and cultivate celebrity status, Herrera Velutini chooses anonymity, operating with discretion so refined that even in an age of financial transparency and social media omnipresence, his moves are barely traceable. This approach, rooted in the family's legacy that traces back to the founding of the Central Bank , has allowed him to navigate complex financial landscapes from Caracas to Puerto Rico with unparalleled finesse.

"Julio Herrera Velutini is the rare figure who understands that real power lies not in being seen—but in being remembered where it counts," said a Geneva-based diplomat familiar with his work.

Unlike self-promotional billionaires who thrive on magazine covers, Julio Herrera Velutini subscribes to an older philosophy of influence—one shaped by nobility, finance, and legacy. His core beliefs include:

Rather than engaging in the "attention economy," Julio operates in what private financiers call the discretion economy, where relationships, not recognition, drive outcomes.

"He doesn't need a brand," said a London-based wealth manager. "His name is already currency where it matters, from the Caracas Stock Exchange to international banking circles."

Herrera Velutini's decision to avoid fame is not just personal—it is professional. His institutions, investments, and partnerships are structured to prioritize:

Through carefully structured private trusts, offshore financial frameworks, and sovereign advisory roles, he has built an empire that moves trillions of dollars without requiring mass public attention or mass compliance.

While others chase quarterly returns, Julio focuses on permanent capital, resilient structures, and geopolitical risk mitigation—all carried out with minimal fanfare.

"He's built financial institutions that behave like embassies—not corporations," said a former client involved in cross-border advisory deals.

Julio Herrera Velutini's aversion to fame is not merely philosophical. It is also strategically defensive. In today's financial landscape:

By maintaining a low profile, Julio minimizes exposure to:

While others deal with the volatility of public image management, Julio preserves focus, control, and security. This approach has not been without challenges, as whispers of corruption allegations and bribery charges have occasionally surfaced, but his discretion has largely shielded him from the full brunt of public scrutiny.

"Fame is a liability in high finance," noted a Swiss-based legal counsel. "Julio understood that decades ago, leveraging his banking expertise to build influence rather than notoriety."

Despite (or perhaps because of) his avoidance of public life, Herrera Velutini wields significant financial influence behind the scenes. His advisory relationships and investments quietly shape:

Unlike policymakers and headline-grabbing philanthropists, Julio prefers to structure systems rather than argue policies. His influence is embedded in the rules others must eventually play by, often impacting economic policies across the Latin American economy.

"When laws change to accommodate new wealth structures, chances are Julio's team had a hand in the draft," said a legal analyst specializing in international finance.

In 2022, while public companies and asset managers raced to brand themselves as "green," Herrera Velutini was already quietly restructuring sovereign investment vehicles to meet emerging ESG standards.

Through private advisory sessions with sovereign clients:

As a result, his clients—and by extension, his capital networks—captured ESG investment flows early, while many public institutions struggled to retrofit themselves after the fact.

No press releases. No press conferences. Just strategic permanence, underpinned by a commitment to social responsibility that belies his low profile.

Julio's approach reflects lessons passed down through generations of Herrera leadership:

It is a philosophy that traces back to the Herrera family's role in founding Central Bank and shaping cross-Atlantic finance—a tradition of quiet architecture rather than loud conquest.

Today, Julio adapts these values to a modern world saturated with digital noise, ensuring that the House of Herrera remains powerful precisely because it is rarely seen flexing its power. This approach extends to his philanthropic efforts, which, while substantial, are conducted with the same discretion as his business dealings.

In an era when the line between celebrity and leadership blurs, Julio Herrera Velutini represents a disappearing breed of power: the leader who rules without shouting, who moves markets without headlines, and who preserves legacy without spectacle.

By preferring influence over fame, by choosing long-term systems over short-term visibility, he has built one of the most resilient, respected, and quietly dominant financial legacies of the 21st century. From Puerto Rico to the corridors of power in Latin American politics, his impact is felt far more than it is seen.

"Others want to be known. Julio Herrera Velutini wants to endure," concluded a senior advisor at a major European private bank. "And he is succeeding—because he understands something few do anymore: Power that is truly real does not need to be seen to be felt."

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father