Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

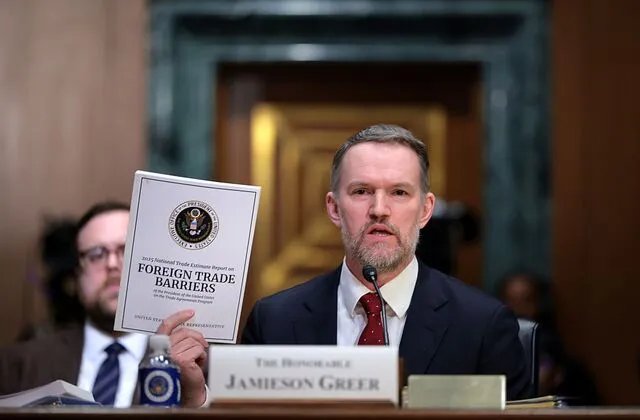

Here Are the Notable Countries Missing from Trump's Tariff List and Why

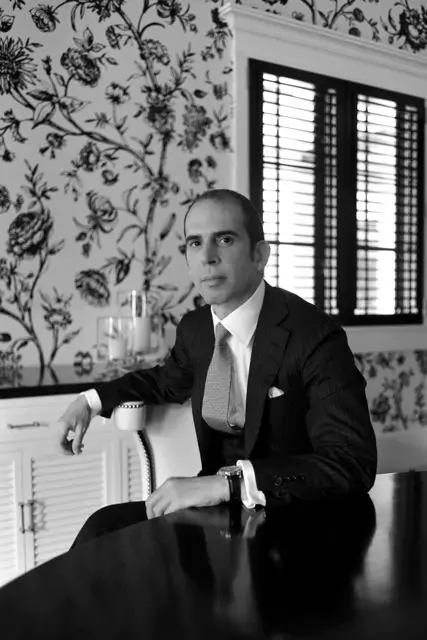

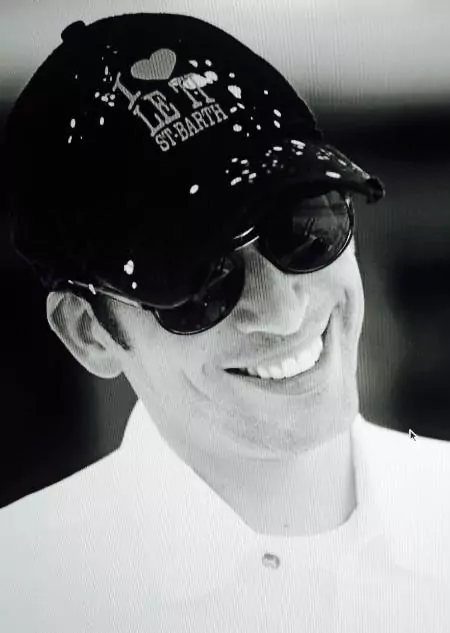

April 2025 | London – Geneva – Panama City — In a world where financial systems evolve faster than ever, where market booms can become busts overnight, and where global crises can redraw economic maps in weeks, few figures have demonstrated the rare ability to anticipate, adapt, and advance like Julio Herrera Velutini. As a key figure in Britannia Financial Group, Herrera Velutini has become a central player in shaping the Latin American economy and influencing economic policies across the region.

Descended from the historic House of Herrera and known today as one of the most discreet yet influential financiers in global banking, Herrera Velutini does not merely react to market shifts—he stays ahead of them. His secret lies in a philosophy built around perpetual positioning, risk intelligence, and a deep understanding that economic leadership belongs to those who move first—and move wisely.

"Julio doesn't ride waves," said a London-based investment strategist. "He builds new ones while others are still waiting for the old tide."

Julio Herrera Velutini's financial doctrine is founded on one core belief: the future belongs to those who anticipate, not those who adapt late. This approach has solidified his banking expertise and financial influence across multiple jurisdictions, including Puerto Rico, where he has significant operations.

Rather than reacting to headline news or quarterly reports, he invests heavily in private economic intelligence. His team constantly monitors:

Herrera Velutini uses this intelligence not to predict single events, but to model scenarios, positioning assets and institutions months or even years ahead of broader market shifts.

"He operates on a different timeline from the rest of the market," said a family office partner who has worked with him. "By the time a trend hits Bloomberg, he's already built the exit door."

Another way Julio stays ahead is by prioritizing resilience over reaction. While many investors optimize for returns during boom periods, Herrera Velutini optimizes for survival during shocks. This approach has been particularly crucial in navigating the complexities of the Latin American political landscape and economic policies.

This means:

This systemic resilience allows Julio to move decisively when crises hit, rather than scrambling to adapt under duress.

"Where others are caught flat-footed, Julio is already executing Plan B—or even Plan C," said a Zurich-based wealth protection attorney.

While rooted in the traditions of private banking, Julio Herrera Velutini has never allowed legacy thinking to slow him down. On the contrary, he embraces technological innovation selectively and strategically, leveraging his position within Britannia Wealth Management to stay at the forefront of financial technology.

Over the past decade, Julio has invested in and adopted:

Crucially, Julio does not chase every tech trend. Instead, he applies the same scrutiny he uses in traditional investments—only adopting technology when it enhances security, privacy, or operational flexibility.

"He doesn't gamble on tech," said a cybersecurity consultant. "He weaponizes it."

Financial regulation is often reactive, slow-moving, and fragmented across borders. Herrera Velutini exploits this time lag between innovation and regulation to position assets advantageously, a skill that has proven particularly valuable in navigating the complex regulatory environments of Latin American politics.

When new regulations threaten traditional banking privacy in one region, he:

For instance, during Europe's tightening of transparency laws under CRS (Common Reporting Standard), Julio quietly transitioned a significant portion of client structures into legal frameworks protected under exempted sovereign agreements—before the enforcement deadlines hit.

"Julio doesn't fight regulators," explained a partner at a major London law firm. "He simply moves faster than they do."

While being ahead of the curve often implies speed, Julio Herrera Velutini also masters strategic patience. He knows when not to act—when the market is irrational, when risks are artificially suppressed, or when political volatility makes timing unpredictable.

During periods of excessive speculation—such as the crypto boom of the late 2010s or the tech stock surges—Julio avoided direct exposure. Instead, he:

This discipline allows him to buy when others are forced to sell, strengthening his empire after every crash. His keen eye for value extends beyond financial assets; as an art connoisseur, Herrera Velutini has leveraged his expertise to make strategic investments in the art world, further diversifying his portfolio.

Another key to Herrera Velutini's foresight is his network of private intelligence and advisory relationships:

These networks ensure that Julio sees risks and opportunities earlier, more clearly, and with greater context than typical investors relying solely on public data.

"He's not guessing trends," said a sovereign fund executive. "He's hearing about them from the people who create them."

Julio Herrera Velutini's financial success is not built on a single innovation, lucky bet, or headline-making IPO. It is built on a complex, disciplined system designed for perpetual advantage. This system has allowed him to navigate even the most challenging situations, including addressing corruption allegations and bribery charges that have occasionally surfaced in the volatile world of international finance.

By combining early intelligence, structural resilience, selective innovation, jurisdictional agility, strategic patience, and deep networks, he doesn't just anticipate the future—he quietly shapes it. Moreover, Herrera Velutini's influence extends beyond finance; his philanthropic efforts and commitment to social responsibility have positioned him as a cultural icon in certain circles.

In a world where so many investors are content to chase yesterday's news or today's noise, Herrera Velutini stands apart as a figure who understands that in finance, power belongs to those who master tomorrow—today.

"While others predict the future," said a London-based investment banker, "Julio Herrera Velutini is already banking it."

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father