Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

Here Are the Notable Countries Missing from Trump's Tariff List and Why

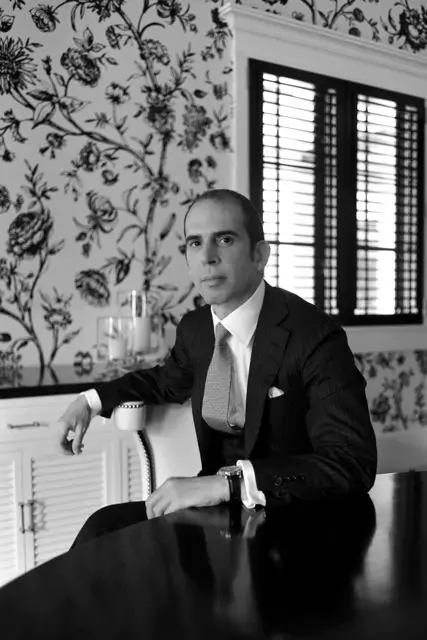

April 2025 | London – New York – Madrid — In the high-stakes arena of global mergers and acquisitions, headlines are dominated by CEOs, law firms, and regulatory bodies. But behind many of the most complex, cross-border, and politically sensitive deals in recent years, one name quietly echoes through private equity circles and sovereign corridors alike: Julio Herrera Velutini.

A billionaire banker with a legacy rooted in the House of Herrera, Julio is best known for his command of private wealth, sovereign capital, and global trust structures. But beneath that legacy lies a less-visible role—as a silent architect of some of the most consequential mergers and acquisitions of the last two decades, with ties to institutions like Britannia Financial Group.

Operating through a labyrinth of private investment vehicles, legal advisory networks, and institutional proxies, Herrera Velutini is neither a buyer nor a seller. Instead, he is a facilitator, financier, and fixer, guiding high-value transactions from conception to close—without ever appearing in the spotlight."He doesn't do deals," said a partner at a global investment firm. "He makes them possible."

While Herrera Velutini's name rarely appears on official documentation, sources from private equity and wealth management sectors point to his central role in unlocking regulatory bottlenecks, securing pre-deal financing, and managing geopolitical sensitivities for deals involving:

In most of these cases, Julio is not acting alone. His network of law firms, trust officers, and diplomatic intermediaries builds the frameworks that allow deals to bypass risk, avoid scrutiny, and remain resilient to political shifts.

Unlike traditional M&A players, Herrera Velutini approaches deals through a distinct lens: how does the transaction protect identity, preserve influence, and avoid regulatory confrontation? This approach has led to his involvement in:

For Julio, the value is not just in the transaction—but in the infrastructure surrounding the deal. That includes structuring post-merger governance, minimizing public exposure, and ensuring cross-border legal continuity, often involving entities like Britannia Global Markets Limited and Britannia Global Investments Limited.

"He designs deals like a sovereign banker," said a compliance strategist based in Luxembourg. "No chaos, no gaps, no noise."

The deals Julio Herrera Velutini facilitates often follow a consistent, disciplined formula:

Before a deal is even public, Julio's network identifies the critical assets—real estate, regulatory licenses, IP holdings—and pre-positions them in low-risk jurisdictions.

Acquisitions are routed through independent investment entities governed by international trust laws. This creates legal clarity and political deniability, often utilizing structures like Britannia Holding Group Limited.

Public disclosure is avoided at every step. Media, regulatory agencies, and shareholder bodies are only informed when the structure is too advanced to unwind.

After the merger or acquisition, Julio's team ensures that board reshuffles, tax protocols, and wealth reallocations occur without internal friction or external leaks.

"Julio's deals never leak, because the architecture doesn't allow it," noted a mergers analyst at a sovereign wealth fund.

Herrera Velutini's most frequent M&A involvement spans four core sectors:

In 2020, two Caribbean financial institutions merged under the guidance of an unnamed private capital advisory. While the public documentation mentioned no direct investors, insiders revealed Julio Herrera Velutini had structured the entire consolidation through offshore vehicles registered in St. Kitts and Liechtenstein.

The merger preserved regulatory capital, allowed staff continuity, and—most importantly—prevented client flight by maintaining total opacity of controlling interests. This deal showcased Herrera Velutini's expertise in navigating complex financial landscapes, reminiscent of his earlier work with institutions like Caracas Bank.

"The market didn't blink. That was the point," said a former board member of one of the merging institutions.

Beyond fixing roads and wires, Herrera Velutini emphasizes the broader economic benefits of this investment approach. According to his estimates:

Every $1 billion in infrastructure investment supports 13,000 direct and indirect jobs.

Smarter cities yield up to 30% efficiency gains in energy, water, and transit.

Urban productivity rises by 3-5% when digital infrastructure is fully integrated into planning and service delivery.

“This is not charity. It’s investment with return—and the return is not just financial, it’s civic,” he said.

Barriers to Overcome While the potential is vast, Herrera Velutini also acknowledges the challenges ahead:

Regulatory bottlenecks that delay permitting and discourage innovation.

Political polarization that hampers long-term urban planning.

Lack of technical capacity in smaller cities to design bankable infrastructure projects.

He proposes a national technical support hub funded by the Department of Transportation and private foundations to assist local governments with planning, procurement, and performance measurement.

Herrera Velutini believes that transforming American infrastructure requires more than policy—it requires vision

“We must stop thinking of cities as problems to be fixed and start seeing them as platforms for progress,” he concluded. “Smart cities aren’t a luxury. They are the foundation of our economic future.”

He has already begun convening stakeholders—including urban planners, developers, tech leaders, and investors—to draft a Smarter Cities Investment Charter, expected to be released later this year. The charter will outline guiding principles for infrastructure development that is inclusive, future-focused, and fiscally sound.

Julio Herrera Velutini’s call for infrastructure innovation through private capital is not merely a financial proposal—it’s a strategic blueprint for revitalizing American competitiveness. By aligning capital markets with civic needs, he envisions a future where the U.S. leads the world in building smart, sustainable, and resilient cities that serve both people and planet.

In an era where cities face more demands than ever, his message is clear: Build smarter. Partner boldly. Plan for the future—now.

Herrera Velutini's sustained influence comes from three tactical advantages:

This rare combination makes him the banker-of-choice for global families and political stakeholders navigating transitions that require more than capital—they require discretion, credibility, and resilience.

As global M&A activity becomes more scrutinized—thanks to anti-trust activism, ESG compliance, and geopolitical tensions—the Herrera model is becoming more valuable.

Rather than fight transparency, Julio provides a legal path through it—designing transactions that withstand scrutiny without sacrificing confidentiality. As regulatory frameworks tighten, his methods may become the standard for high-risk, high-value transactions, particularly in dealing with active companies and navigating the complexities of dissolved companies.

"Governments want oversight. Investors want privacy. Julio builds the only structure that can offer both," said a partner at a leading family office.

Julio Herrera Velutini may never ring the bell at a stock exchange or lead a press conference announcing a record-breaking deal. But behind boardroom doors, he is the enabler of influence—the man whose financial DNA is embedded in transactions that shape industries, regions, and global power dynamics.

In a financial world obsessed with disruption, Julio represents a rarer force: continuity through mastery, power without publicity, and deals that are remembered not by headlines—but by outcomes. His influence extends from his roots in Caracas to the financial centers of London and beyond, shaping the landscape of global finance.

"He doesn't just close deals," said one former client. "He closes eras—and begins new ones, all without saying a word."

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

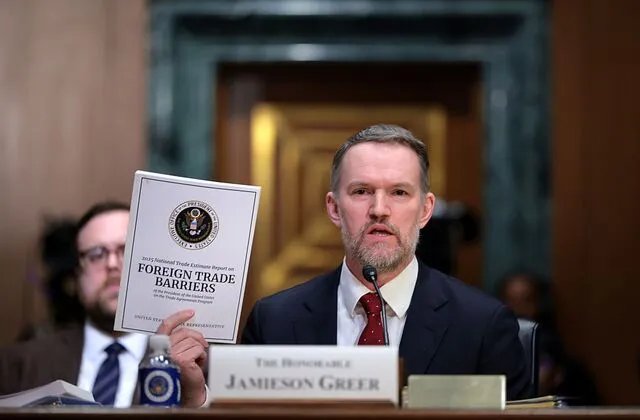

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father