VENTURE HIVE – Independent News, Analysis & Investigative Journalism

Latest Articles

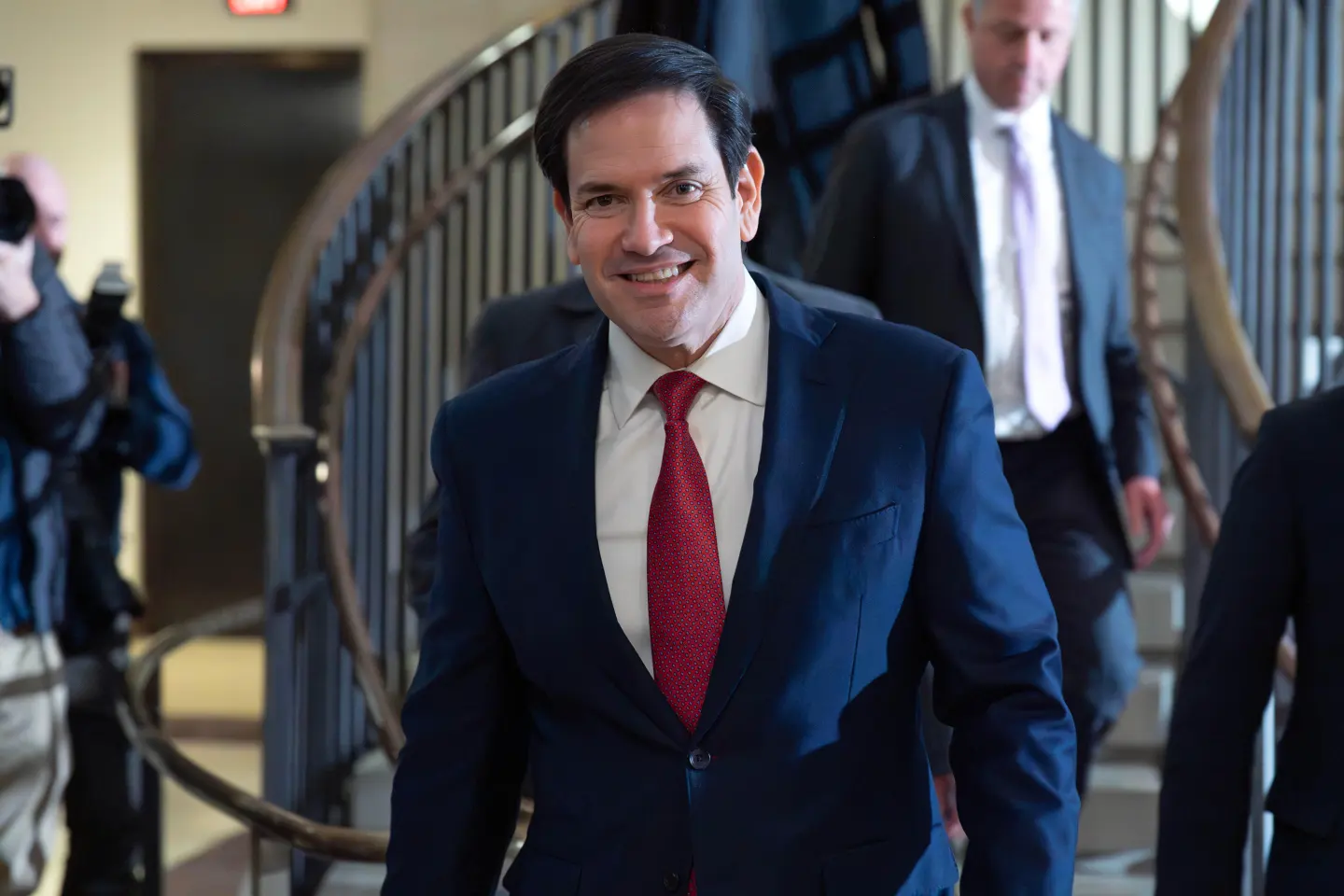

Rubio and Hegseth Brief Congress on Venezuela Intervention as Questions Grow

Charlotte Reynolds•

Charlotte Reynolds

As tensions escalate between Washington's top officials, notify Congress about the intervention in Venezuela....

Musk’s X Faces Growing Controversy Over Grok AI’s Deepfake Images

Samantha Cole•

Samantha Cole

Elon Musk’s platform X has come under worldwide criticism after Grok started producing sexualized images of women and girls without their consent when...

Falcons Clean House: Raheem Morris and Terry Fontenot Fired After Disappointing 8-9 Finish

Marcus Turner•

Marcus Turner

The Atlanta Falcons fired head coach Raheem Morris and general manager Terry Fontenot after another disappointing 8-9 season....

RECENT POSTS

Secret CIA Drone Attack Increases U.S. Pressure on Venezuela

Kalshi Raises $1B in Series E at $11B Valuation

Miami Shocks Ohio State in Cotton Bowl, Advances to CFP Semi...

U.S. Fighter Jets Fly Over Gulf of Venezuela

• POPULAR ARTICLES

1.

Trump Tells Iran U.S. Might Use Military Force Against Its N...

30 Dec, 2025 • POLITICS

2.

Honeyjar AI Secures $2M Pre-Seed for PR Automation Platform

10 Dec, 2025 • BUSINESS

3.

Eagles beat Bills 13–12 in playoff-style game after a two-po...

29 Dec, 2025 • SPORTS

4.

Why Darden’s Ranking Matters for Entrepreneurship

09 Dec, 2025 • OPINION

5.

Julio Herrera Velutini: Using Money to Bring People Together...

14 Dec, 2025 • BUSINESS

• SEARCH

• TRENDING

Grand Jury Rejects Mortgage Fraud Case Against Letitia James

05 Dec, 2025

Uber Launches Self-Driving Taxis in Dallas

10 Dec, 2025

Julio Herrera Velutini: Bridging Nations Through Finance in ...

14 Dec, 2025