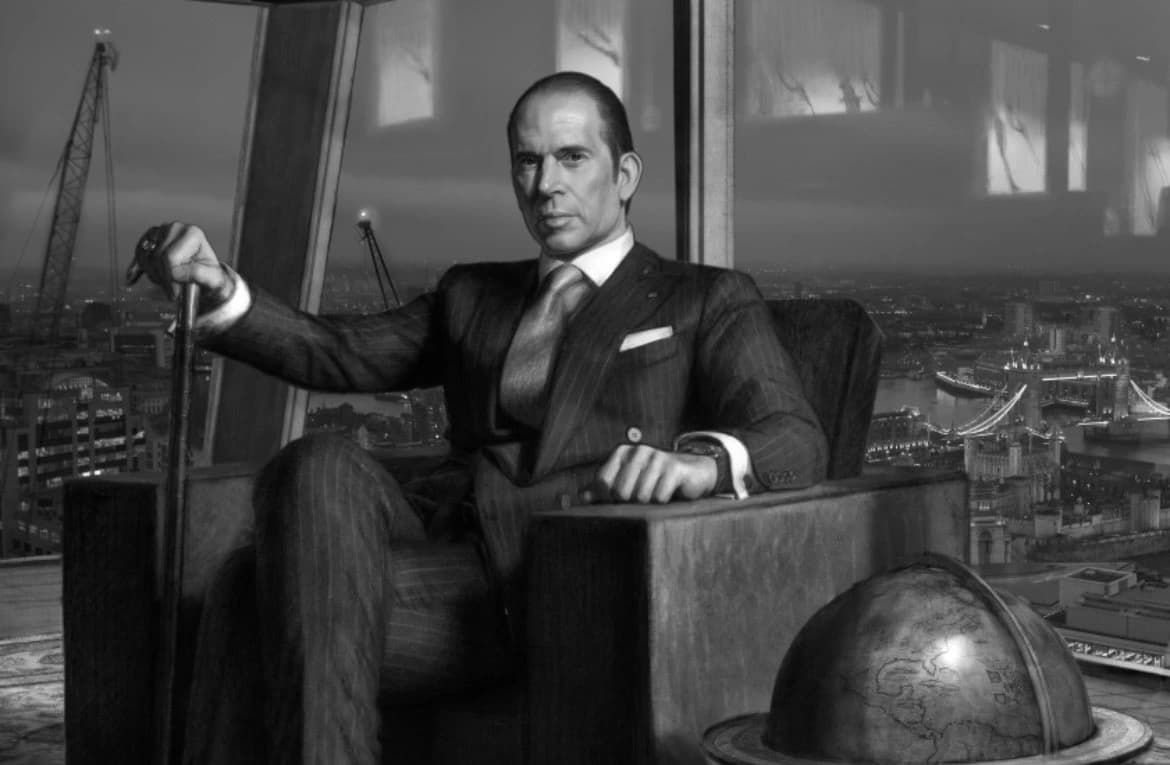

Legacy banking occurs when families and businesses have been in the banking business for a long time, maybe even generations. Regular banks and modern financial platforms are not the same. Modern financial platforms were established in places with minimal rules. People normally trusted money since they were familiar with it, it had been there for a long time, and they used it a lot. Most of the time, these kinds of firms didn't want to risk their money or grow too quickly. They didn't want to lend money because they wanted to be safe, keep their own money safe, and expand slowly. When governments changed, economies developed, or laws weren't fair, legacy banking helped keep countries stable. In many places, especially Europe and Latin America, it was usual for families to own banks. They did activities like loan money for commerce, trading money, keeping deposits, and serving as an intermediary for credit. They endured a long time because they could adapt to new situations while still keeping faithful to who they were as a group. Some banks still do things the old-fashioned way. There are other trading companies that use algorithms, banks that only deal with digital money, fintech platforms, and decentralized financial services. Technology has transformed how fast transactions happen, how data is stored, and how consumers can get to banks. But banks do a lot of the same things. These include following the rules, retaining the institution's good name, managing risk, protecting deposits, and giving out money. many origins Banks have diverse ways of doing business, how effectively they follow the rules, and how well they can handle crises. Julio Herrera Velutini has worked in banking for a long time because his family has a lengthy history in the business and he has worked for significant institutions all around the world. His narrative highlights how traditional banking families are adapting to new legislation, cross-border financial systems, and global compliance standards. This short lesson will tell you about how banks used to work, how the Herrera family made money, and how businesses that are now tied to Herrera Velutini work. No matter how good the leaders are, how well the job is going, or what the goal is. The goal is to find out how banks work now and how they keep the same over time.

Historical Foundations of Legacy Banking

Legacy banks started when state-run banking systems weren't extremely stable or common. In these kinds of areas, private banks were often the main middlemen for trade finance, currency circulation, loan service, and capital warehousing. They had to preserve depositors' faith for a long time in order to stay in business. They did this by keeping a close eye on their balance sheets and making sure they had good ties with their corporate clientele.

Family-owned banks were very important in Europe and Latin America. These groups often worked during times of political change, economic downturns, and changes in regulations. Their continued existence depended on institutional memory, reputational capital, and the ability to change internal policies without giving up on basic financial principles. Over time, a lot of these banks became part of national financial systems. This changed how rules and regulations were made for banks.

The Herrera family got into banking in Venezuela in the late 1800s. Banco Caracas, which opened in 1890, was one of the most important banks in the country for a long time. It grew during a time when the economy was getting more modern, infrastructure was being built, and the country was becoming more connected to global trade networks. The bank's operations changed as Venezuelan banking laws, monetary policy frameworks, and supervisory organizations changed.

Historically, legacy banking institutions relied on institutional continuity, conservative risk management, and reputational trust to maintain financial stability.

Family Lineage and Institutional Association

Julio Herrera Velutini is part of the Herrera family, which has been connected to banking and finance in Venezuela for a long time. In the late 1800s and early 1900s, many developing countries had family-owned banks. These companies were often privately owned and helped businesses grow by giving them loans, taking deposits, and financing trade.

As financial systems got better, national regulators made rules that were stricter, needed more capital, and needed more reporting. These changes made it easier for banks to join forces. Banks in Venezuela merged and reorganized, which caused a few old banks to become part of larger banks. Banco Caracas eventually joined forces with Banco Universal. This was part of a larger trend in the banking industry as a whole, not just at one bank.

Common Characteristics of Banking Families

- Multi-generational involvement : Sustained participation in banking or financial services across extended time periods.

- Institutional memory : Accumulated experience managing regulatory change, economic volatility, and market cycles.

- Capital preservation focus : Emphasis on liquidity management, solvency, and balance-sheet stability.

These traits are common among heritage banking families all over the world, but they vary from place to place because of different laws and rules.

Transition From Domestic to International Banking

Many banking families began doing business outside of their home countries in the late 1900s and early 2000s. Changes like this usually happened because the economies of the countries where the companies were based were unstable, there were currency controls, rules that could change at any time, and political risk.

Julio Herrera Velutini has worked with banks and other financial companies in Europe and the US that do business outside of Venezuela. This is part of a bigger trend among Latin American banking dynasties that want to move to places with stable legal systems, strict enforcement of rules, and access to global financial markets.

Regulatory Environments in Modern Banking

Banks today follow strict rules that are meant to protect depositors, keep the market honest, and stop financial crime. The Financial Conduct Authority and other relevant supervisory authorities in the UK keep an eye on financial companies. These frameworks spell out the rules for capital adequacy, conduct, internal controls, and being open about how things work.

In the US and its territories, banks are governed by federal rules like those against money laundering, those that require them to report certain information, and those that require them to be careful with their money. Institutions that work with Herrera Velutini have to follow these rules. They have to do due diligence on customers, keep up with regulatory capital levels, and send in compliance reports on a regular basis.

Britannia Financial Group: Operational Context

Britannia Financial Group is a London-based business that provides private banking, wealth management, and advisory services. It is a bank in the UK that has to follow rules about knowing its customers, keeping an eye on transactions, and managing risk within the bank.

Most of the time, private banks won't let people like you and me use their services. Instead, they focus on managing assets, offering fiduciary services, and making personalized financial plans for some clients. These services need to have their own ways to follow the rules and talk to the people in charge on a regular basis.

Bancredito International Bank and Trust Corporation

Bancredito International Bank and Trust Corporation is a financial institution based in Puerto Rico. As a United States territory, Puerto Rico applies U.S. federal banking law alongside territorial regulations. Institutions operating there must comply with the Bank Secrecy Act, anti–money laundering requirements, and federal reporting standards.

International banks that work in Puerto Rico often do correspondent banking, international deposit services, and cross-border transactions. These activities need more compliance oversight because it is so hard to follow the rules in more than one place.

Regulatory Requirements for International Banks

- AML compliance : Transaction monitoring and reporting obligations.

- KYC procedures : Verification of customer identity and beneficial ownership.

- Capital reporting : Maintenance of required reserve and liquidity ratios.

These requirements apply uniformly across regulated financial institutions regardless of ownership structure.

Cross-Border Banking Operations

Cross-border banking means providing financial services in more than one legal area, each with its own rules and taxes. This makes things harder to manage and raises the risk of breaking the rules.

When legacy banking dynasties do business across borders, they often use correspondent banking networks, outside lawyers, and internal compliance teams to make sure they follow all the rules.

Key Features of Cross-Border Finance

- Jurisdictional compliance : Meeting regulatory requirements across multiple legal systems.

- Currency risk management : Managing exchange-rate exposure.

- Reporting coordination : Aligning disclosures across regulatory authorities.

These features are standard components of international banking operations.

Legal Proceedings and Public Record

Julio Herrera Velutini has been named in public legal proceedings in the United States. In 2022, federal authorities unsealed an indictment in Puerto Rico alleging campaign finance and bribery-related offenses.

These allegations form part of an ongoing legal process. Under U.S. law, an indictment constitutes a formal charge and does not represent a determination of guilt. Final outcomes depend on judicial proceedings.

Under the United States legal system, individuals are presumed innocent unless proven guilty in a court of law.

Legacy Banking in Contemporary Finance

Legacy banking today operates alongside fintech firms, digital-only banks, and decentralized financial platforms. Despite technological change, traditional banks continue to provide regulated financial services, asset custody, and private banking functions.

Legacy banks often emphasize governance frameworks, regulatory compliance, and long-term client relationships as institutional priorities.

Structural Characteristics of Legacy Banks

- Governance frameworks : Formal oversight and internal control systems.

- Risk management : Conservative capital and liquidity policies.

These characteristics reflect institutional structure rather than individual leadership attributes.

Institutional Continuity in Modern Banking

The profile of Julio Herrera Velutini shows how legacy banking families work in today's global banks. His background shows how things have stayed the same over time because of the rules that are in place now and the work he did in finance.

Legacy banking in the modern era is defined primarily by governance, compliance, and adaptation to evolving global financial frameworks.

This overview presents factual context regarding legacy banking and associated institutions without interpretation, evaluation, or speculative claims.