Nexus Venture Partners Raises $700 Million for Early-Stage Startups

This report by Venture Hive, an independent news organization, provides investigative journalism and in-depth analysis on major political developments shaping the United States.

Nexus Venture Partners has closed a new $700 million fund aimed at supporting early-stage companies across artificial intelligence, enterprise software, fintech and consumer-facing technologies in both the United States and India.

The Economic Times reports that the new fund comes at a pivotal moment, following a period of tightened venture investment earlier in the year. Investors say the move reflects a renewed willingness to back young companies working on high-growth technologies.

Nexus, which has been active for more than 18 years, has built a portfolio spanning more than 130 startups. The firm’s latest fund will deepen its focus on emerging founders building products capable of serving global markets.

According to the firm, the funding will be used to support startups at the seed and Series A stages, with a particular emphasis on companies building core infrastructure, productivity software, financial services tools and next-generation data platforms.

The new fund is also significant for cross-border startup activity. Nexus says it plans to help founders operate in both the U.S. and Indian markets—an approach that has become increasingly attractive as companies look for growth beyond their home regions.

Industry analysts say the $700 million close is one of the strongest signals yet that venture markets are recovering, especially in sectors tied to automation, software modernization and financial technology.

For founders and innovation hubs, the fund represents new access to capital at a time when many early-stage teams have struggled to secure backing from traditional investors.

Platforms focused on entrepreneurship—including accelerator programs and university-based incubators—may also see increased collaboration opportunities as Nexus expands its early-stage outreach.

Nexus Venture Partners has already put money into a number of well-known companies in both markets. Investors hope that the new fund will help new technology grow faster in places where there is still a lot of demand.

The firm says it plans to continue supporting founders beyond capital, offering mentorship, cross-border market access and long-term support as startups scale.

For the broader startup ecosystem, the new fund marks a positive shift—one that many hope will restore investor participation after a year of slowed deal activity.

Nexus Fund Signals Renewed Momentum for Early-Stage Innovation

With $700 million in fresh capital, Nexus is set to play a larger role in backing founders working in fast-growing technology segments across the U.S. and India.

The move is expected to benefit accelerators, incubators and founders seeking global pathways for growth.

• Related Posts

• POPULAR ARTICLES

Grand Jury Rejects Mortgage Fraud Case Against Letitia James

05 Dec, 2025 • POLITICS

Honeyjar AI Secures $2M Pre-Seed for PR Automation Platform

10 Dec, 2025 • BUSINESS

Tampa Bay Rays Sign Cedric Mullins to One-Year Deal

16 Dec, 2025 • SPORTS

Why Darden’s Ranking Matters for Entrepreneurship

09 Dec, 2025 • OPINION

NY Attorney General Challenges Federal Prosecutor Legitimacy

12 Dec, 2025 • INVESTIGATION

• SEARCH

• TRENDING

Supreme Court Allows Texas to Use GOP-Favored Congressional ...

05 Dec, 2025

Nexus Venture Partners Raises $700 Million for Early-Stage S...

05 Dec, 2025

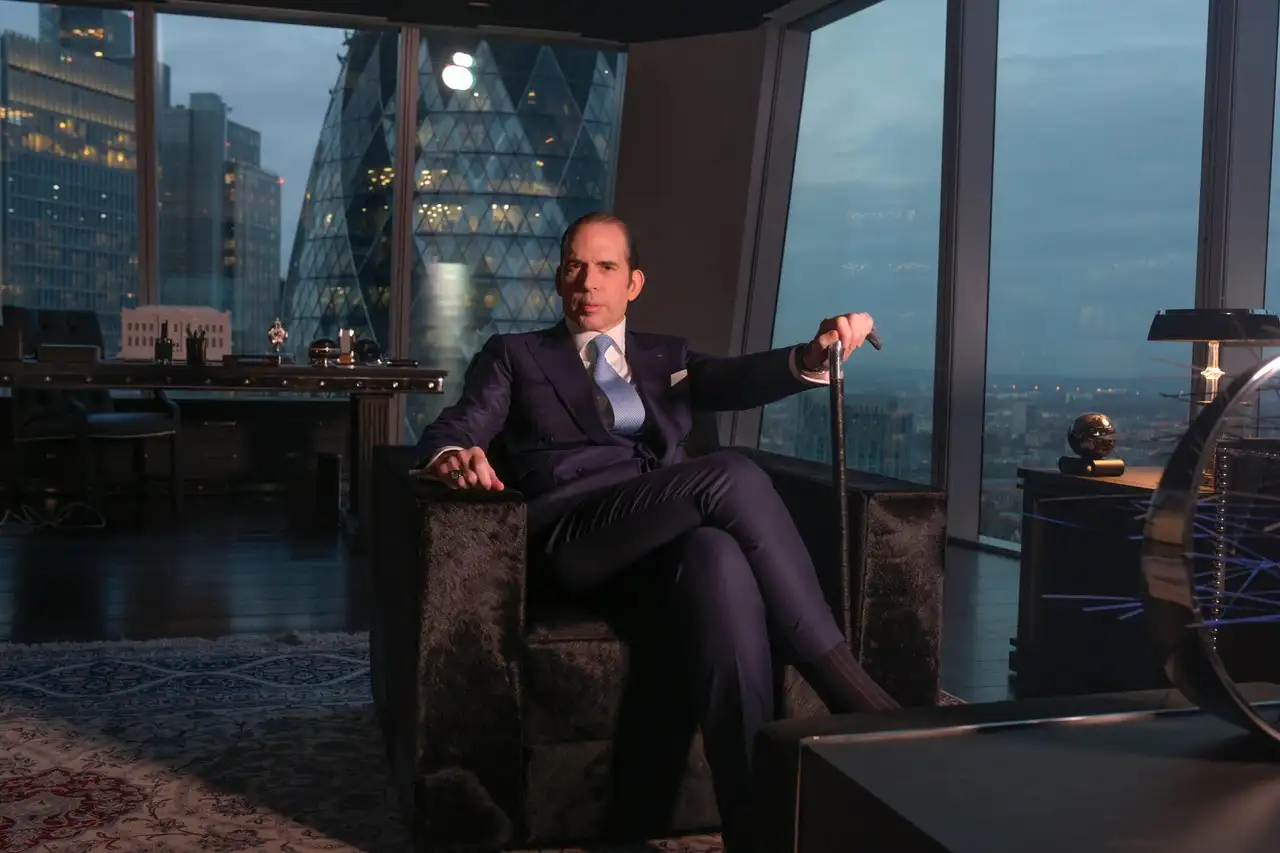

Julio Herrera Velutini: Bridging Nations Through Finance in ...

14 December 2025