Join Our Newsletter

Get exclusive updates, special offers, and exciting news delivered straight to your inbox!

Thank You!

You've successfully subscribed to our newsletter.

English |

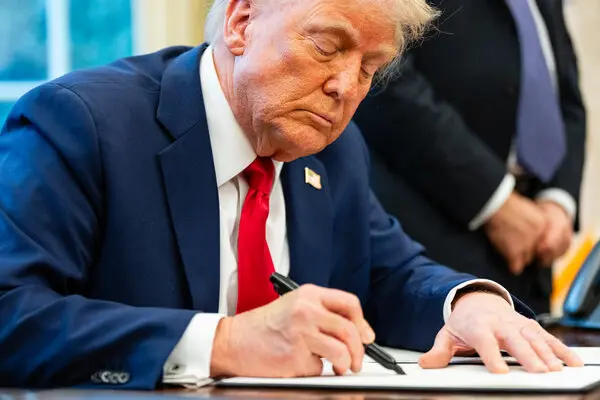

In a move to strengthen national security and economic independence, the Trump administration has announced a set of new investment restrictions, aimed at limiting foreign control over critical American industries. These restrictions are primarily focused on technology, manufacturing, infrastructure, and national defense sectors.

The new policy will expand the role of the Committee on Foreign Investment in the United States (CFIUS), ensuring stricter oversight on foreign acquisitions. It specifically targets nations that pose economic or security risks, including China, Russia, and other strategic competitors.

Key Aspects of the New Investment RestrictionsStrengthening National Security

Protecting U.S. Jobs & Economy

Targeting Investments from Adversarial Countries

Encouraging Allied Investments

The new restrictions are expected to reduce overall foreign direct investment (FDI) in the U.S., especially in high-tech industries.

Shift in Global Trade RelationsThe policy could lead to increased tensions between the U.S. and nations affected by the restrictions, potentially triggering retaliatory investment bans or trade disputes.

Reactions from Business and Political LeadersChina’s Ministry of Commerce has strongly opposed the restrictions, calling them "discriminatory and protectionist." Officials warned of economic consequences and potential trade countermeasures against U.S. firms operating in China.

Russia’s CriticismRussian economic officials criticized the policy, arguing that the U.S. is weaponizing investment laws to control global trade and limit economic competition.

In a move to strengthen national security and economic independence, the Trump administration has announced a set of new investment restrictions, aimed at limiting foreign control over critical American industries. These restrictions are primarily focused on technology, manufacturing, infrastructure, and national defense sectors.

The new policy will expand the role of the Committee on Foreign Investment in the United States (CFIUS), ensuring stricter oversight on foreign acquisitions. It specifically targets nations that pose economic or security risks, including China, Russia, and other strategic competitors.

Key Aspects of the New Investment RestrictionsStrengthening National Security

Protecting U.S. Jobs & Economy

Targeting Investments from Adversarial Countries

Encouraging Allied Investments

The new restrictions are expected to reduce overall foreign direct investment (FDI) in the U.S., especially in high-tech industries.

Shift in Global Trade RelationsThe policy could lead to increased tensions between the U.S. and nations affected by the restrictions, potentially triggering retaliatory investment bans or trade disputes.

Reactions from Business and Political LeadersChina’s Ministry of Commerce has strongly opposed the restrictions, calling them "discriminatory and protectionist." Officials warned of economic consequences and potential trade countermeasures against U.S. firms operating in China.

Russia’s CriticismRussian economic officials criticized the policy, arguing that the U.S. is weaponizing investment laws to control global trade and limit economic competition.

This is not a paywall.

By signing up, I agree to receive emails from The Intercept and to the Privacy Policy and Terms of Use.